What comes to your mind when you think of a forex trader? Probably a young guy with a Porsche 911 or a Lamborghini. Yes, you can make a lot of money trading the forex market.(Interested in knowing exactly how much you can earn from the Forex market in a month?) Probably enough to buy a Lamborghini Gallardo, if you work hard enough. I have compiled for you a step by step starter guide on how to be a forex guru. Let us look at some basics first though.

Why should you participate in the forex market?

Trading the forex market is the most popular way to make money online, for good reason. For one, you are able to make money even in times of economic depression. This is a big contrast from the stock and bond market where returns are affected by the performance of a country’s economy. The explanation for this phenomenon is simple. Trading in a currency involves buying and selling two currencies simultaneously. This means that when there is trouble in a specific country, you can sell that countries currency and make money. If the economy is good, you can buy that countries currency and still make money.

The other reason why you should jump on the forex bandwagon is the fact that you can work from anywhere. All you need to make money is a computer and an internet connection. Oh! And the knowledge on how to make a trade. Well, you take care of the infrastructure and we will surely deliver the information.

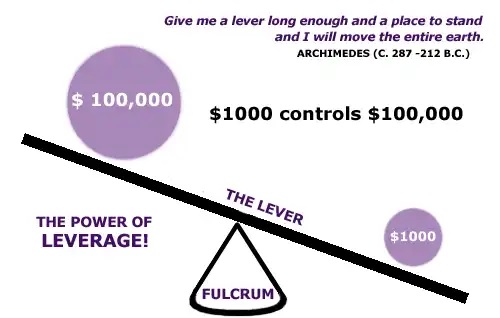

The other good thing about forex is you can start really small. $100 small, to be specific. The magic that makes this happen is called leverage. leverage enables you to buy a large number of currencies while putting up a small amount of money (margin). The leverage ratio depends on your forex broker and country of origin. Some forex brokers offer a leverage of up to 1:1000. This means that with an account of 100 dollars, you can buy currencies worth 100,000 dollars. Beware! Leverage is a double-edged sword. In case a trade goes against you, your account will blow up fast. You should, therefore, use high leverage with caution.

Additionally, Forex is popular with beginners because of its simplicity. There are a million and one shares and bonds out there. To identify the right one, you have to go through tones of financial reports. You also have to make “the right guess” when making a purchase. In Forex you only have to know about the eight main currencies. This is a manageable number. Since you are researching only eight nations, doing financial analysis is relatively easy.

Liquidity is another reason why you should be part of the forex market. It is estimated that the Forex market is worth up to 1,378 trillion US dollars. That is a huge amount of money. It means that you can buy and sell large amounts of currency anytime.

The Basics of Forex Exchange.

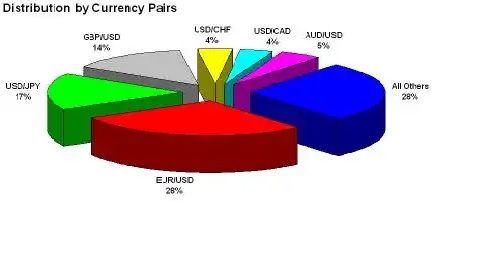

“To succeed, you will soon learn, as I did, the importance of a solid foundation in the basics,” Allan Greenspan. Let us start with what FOREX stands for. FOREX is short for foreign exchange. It is an international currency market with deals worth about 5.1 trillion US dollars daily. As stated earlier trading in the forex market involves two currencies at once. In essence, this means a trade is a comparison between the economic situations of two countries. Below are some of the most common currency pairs:

1. EUR/USD- This is the main currency pair. One-third of all deals in the forex market involves this currency pair.

2. GBP/USD

3. USD/JPY

4. USD/CHF

5. EUR/JPY

6. USD/CAD

Another basic principle that beginners get wrong is the distinction between the base and quote currency. The base currency is the first currency in the pair. Its value is usually one. In the USD/CHF currency pair, USD is the base currency. The quote currency is the second currency in the pair. In this case, it is the Swiss Franc (CHF). Its value is the one that changes depending on market factors.

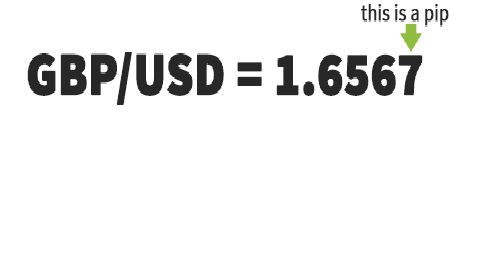

Let’s get to the interesting stuff. A pip and a spread. A pip is the smallest price change that can be measured. It is usually the fourth unit after a decimal unit, 0.0001. When you purchase a standard lot size of 100,000 currencies, a one pip movement means you make 10 dollars. Remember that buying a standard lot size requires a large account. With limited capital, you can only buy a mini or a micro lot.

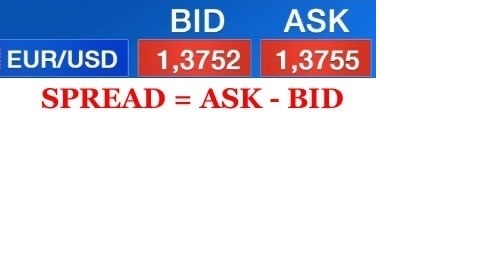

Spread on the other hand is what the forex broker charges you to enter the trade. It is the difference between the quoted buying or selling price and the actual market price. This is usually a small cost usually one pip for the EUR/USD. There are many more good websites you can use to learn forex trading.

The Best Time to Trade the Forex Market.

Now that you know all the basics. Let us focus on more advanced concepts. One such concept is the best time to trade the forex market. The Forex market is open 24 hours. This is because currencies are traded in different parts of the world at different hours. The first session is the Asian session followed by European market and finally the US market. It is common knowledge that there is a time and a session for everything under the sun. This basic principle is still useful when trading the forex market. The best time is when there is a large number of market participants. This scenario happens when there are overlaps between trading sessions. The best of this overlap is the overlap between the London and the New York session. This is usually around 10 am Eastern time. At this time the London/ European market is preparing to close and the New York/ US market is just opening. Trading around this time ensures you are most productive. Additionally, Tuesday and Wednesday are the best days to trade. Friday is busy too but only up to midday. From midday onwards the market becomes unpredictable.

What Moves the FOREX Market?

“Anything and everything can move the Forex Market,” so goes the old adage. You know this is not always true. There have to be several factors that are more important than others. Yes, there are. And I have identified the three main ones for you.

1. Central Banks

A country’s Central Bank is responsible for controlling the supply of currency. It is therefore natural that decisions and statements by central banks affect the value of currencies. When a Central bank increases interest rates this increases the value of that currency. A higher interest rate increases the demand for a currency. This, in turn, reduces supply. Low-interest rates, on the other hand, have the opposite effect. Less demand, increases supply, hence a lower value. A high-interest rate policy is referred to us a hawkish policy. A low-interest rate policy, on the other hand, is referred to as a dovish policy.

2. Economics of a state.

Every now and then a country releases economic data. This is the time to make money if you are a player in the Forex market. This data includes; Gross Domestic Product, inflation rates, debt, amount of sales, and interest from investors. It is not hard to track this data. Your forex broker will always provide them directly to your account. All you have to do is to interpret whether they are positive or not.

3. Politics

Political factors are probably the most unpredictable factor of them all. A politician can give a statement any time. This will have an impact on the market immediately. Take the example of Brexit. The pound vs the US dollars dropped to the lowest price in ten years. Conversely, when Trump was elected president the dollar rose to a two year high. These two examples show how political situations can cause volatility in currency markets. A good trader should always be informed about such political happenings. Look out for the stability of a government, public statements by officials, and change in leadership.

Coming Up with a Trading Plan.

“Not planning is planning to fail,” Benjamin Franklin. If you want to become a successful trader, you have to come up with a trading plan. A trading plan can be based on any of the following three principles:

1. Fundamental analysis.

Trading plans based on this principle put a lot of emphasis on finding out the intrinsic value of one currency relative to the other. Such traders examine economic news, Central bank reports, and political situations.

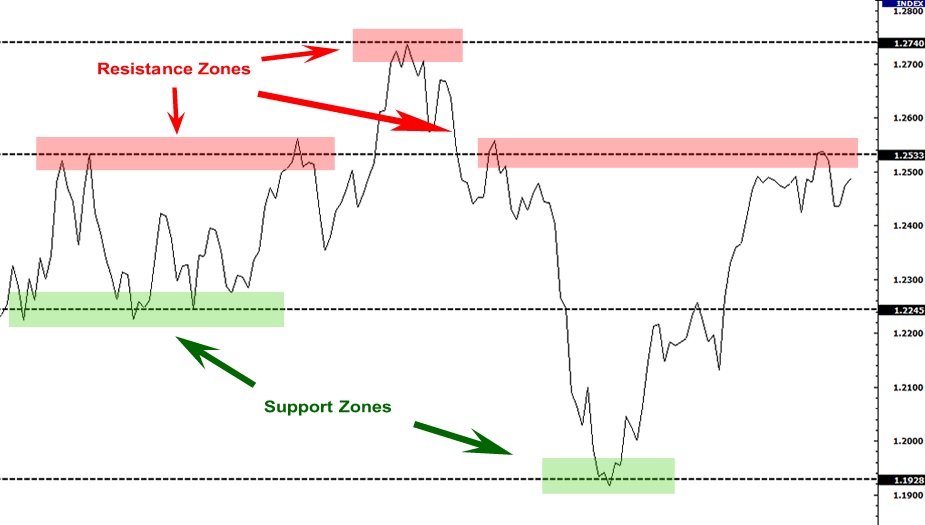

2. Classical charting.

This is also referred to as naked trading. Trade decisions are made by interpreting charts the way they are. Indicators are not used in any way. Looking at the charts it is important to identify two things. The first is the trend. Is it up, down or neutral? The second is to identify support and resistance. These are points where price turns constantly.

3. Technical analysis

This technique is the most famous of them all. It heavily relies on indicators to make important trade decisions. There are two groups of indicators:

A) Trend-following indicators

They include moving averages, MACD Lines (moving average

convergence-divergence), the Directional System, On-Balance Volume,

Accumulation/Distribution, and others. Trend-following indicators are coincident or lagging indicators—they turn after trends reverse. In a non-trending market, the give false buy and sell signals.

B) Oscillators help identify turning points.

They include MACD-Histogram, Force Index, Stochastic, Rate of Change, Momentum, the Relative Strength Index, Elder-ray, Williams’s %R, and others. Oscillators are leading or coincident indicators that often turn ahead of prices. In trending markets, they give false signals.

If you choose the technical approach it is important to combine an oscillator and a trend following indicator.

My approach in forming a trading plan is to combine fundamental analysis, technical analysis, and classical charting.

Test Your Plan

You have to get comfortable with your trading plan. This way you will trust it even when you have a losing streak. There are two steps to the testing process.

1. Backtesting.

In backtesting, you find out the performance of your trading system using past data. You can do this using an MT4 account. This is, however, less effective. The best way to do this is to use a software that is solely dedicated to back testing. My favorite software is forex Tester. Its most current version is version three. By back-testing, you get a lot of trading experience over a short period of time.

2. Forward Testing.

Although backtesting is great. It does not simulate the real market situation one hundred percent. For this, you have to forward test your system. To forward test you will need to open a demo account with a forex broker. Trade the way you would trade with real money for some time. When you are satisfied with the results, you are done with testing. Now you are ready to trade on a live account with real money. Be sure to stick to your trading plan irrespective of the circumstances.

Money management Principles in Forex

Money management is the most neglected aspect of trading. This is despite risk management being the single most important determinant of success. Two things should always guide you. Never risk more than two percent of your account on a single trade. This ensures that one losing trade does not wipe out all your profit.

Secondly, you should never lose more than six percent of your trading account in one month. If you lose 6% take the rest of the time off and assess your trading strategy. This way you will avoid trading to recoup your losses. Doing this only leads to more losses. This two rules should never be broken. Unless you have no interest in becoming a successful trader.

I Am Ready To Start, Help Me Choose A Forex Platform.

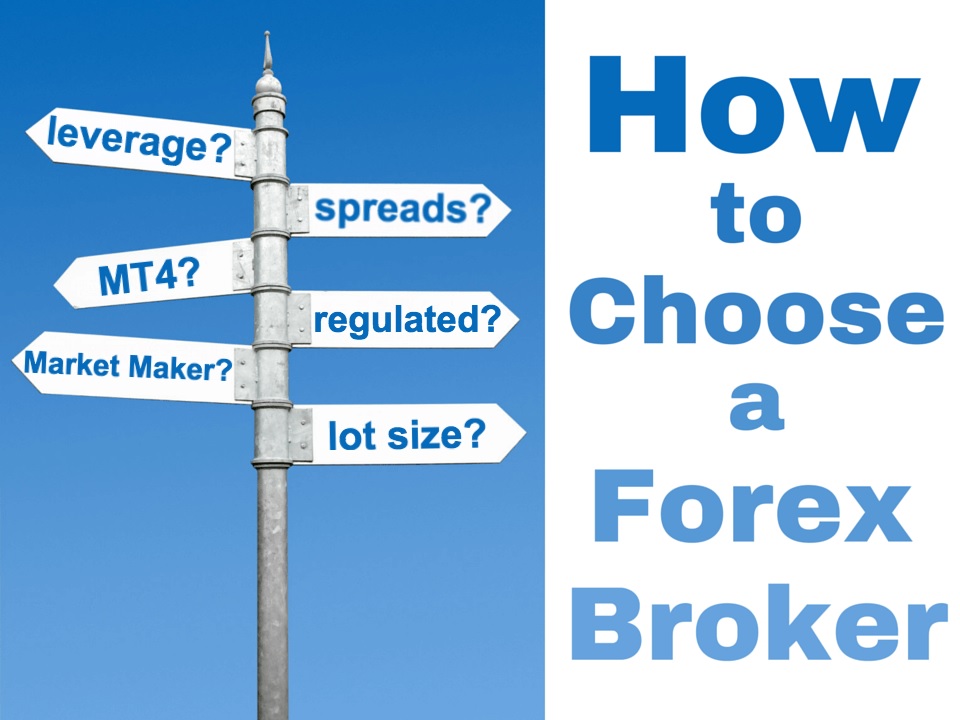

Well, No need to worry mate. I am here for you. Knowing the right platform for you depends on several factors. One such factor is the region you live in. The US has strict regulations which brokers have to follow. As a result, not all brokers allow US customers. If you are from America, kindly check which brokers allow American citizens? The rest of the world operates with close to similar financial guidelines. As a result, they have a larger number of Forex brokers to pick from.

Another factor has to do with the reputation of the Forex broker. Choose a broker who has been in the business for at least ten years. Also, ensure the broker you choose adheres to specific regulatory guidelines. In the US a retailer should have certification from the National Futures Association and the U.S. Commodity Future Trading Commission (CFTC).

Finally, look at the account details of the package you get from the retailer. How much spread is charged? What is the maximum leverage and margin on the account? What is the minimum initial deposit? How easy is it to deposit and withdraw funds from the account? How many currency pairs can you trade? How is their customer service? Do they offer MT4 and MT5 platforms?

Below are some of the popular forex brokers:

e toro

Ava FX

Easy Forex

UFX Market

Plus 500

Insta Forex

FX Pro

City Index

Well, now that you know all the basics of Forex Trading, It is time to take action. Do not wait for the conditions to be perfect because they will never be.